EU Taxonomy: What Is It and What to Do?

Dear Readers,

Today’s article will inform you about so-called EU Taxonomy classification system (hereinafter the “EUT”), which is an additional element to enhance efficient redirection of capital investments across the EU and to meet goals of the Green Deal.

The EUT is based on Regulation (EU) No. 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) No. 2019/2088. The system has been designed to define what can be considered environmentally sustainable economic activities. Being part of an EU’s wider initiative supporting sustainable funding and investments, the EUT provides criteria and standards for various economic sectors. The framework’s purpose is to facilitate transiting to greener economy and to enhance transparency and investor’s trust.

EU Taxonomy’s Schedule

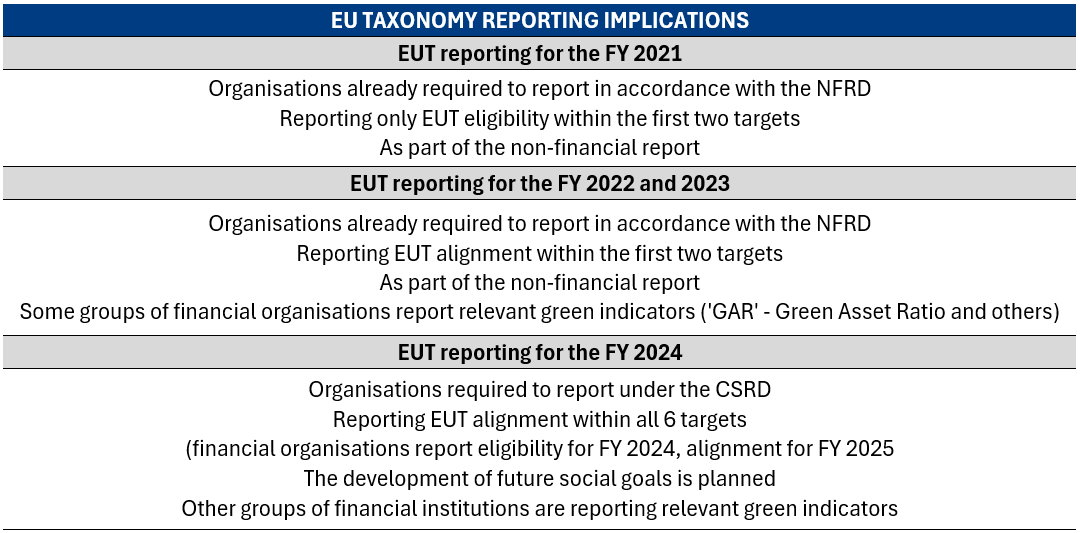

Implementation of the EUT brings along additional reporting requirements for concerned companies. Article 8 of the EUT points out the EUT’s following upon the CSRD (Corporate Sustainability Reporting Directive) and, as a result, the duty to report under the EUT applies to companies together with the duty to comply with the NFRD reporting, and the CSRD from 2024. Information is disclosed in the sustainability report within annual reports, but is governed by dedicated rules applying to the EUT reporting. Please find below the EU Taxonomy schedule.

EUT Goals and Activities

The EUT in general seeks to assess activities, turnovers, costs and investments of companies for EUT eligibility and for compliance with the EUT against the existing six environmental goals. Those goals are intended to make sure that EUT eligible economic activities contribute to the EU’s environmental and climate goals:

- Climate change mitigation;

- Climate change adaptation;

- Sustainable use and protection of water and marine resources;

- Transition to a circular economy;

- Pollution prevention and control; and

- Protection and restoration of biodiversity and ecosystems.

The EU’s plan is to expand those environmental goals by social goals. There should be three optional social goals to start with: dignified employment, adequate standard of living, and inclusive society.

An economic activity is eligible under the EUT, if capable of contributing to any of the environmental goals (i.e. is included in the EUT). Activities complying with the EUT significantly contribute to the particular goal (meet technical screening criteria of substantial contribution, comply with the DNSH criteria, i.e. do not result in a major damage to any of the other five goals, and provide minimum guarantees). To make identification of activities’ eligibility easier, the European Commission developed so-called EU Taxonomy Compass, which is now only available in English. Additional assistance is provided by the Q&A Platform for sustainable funding, which contains questions that have been answered so far or where questions can be asked through a form.

EUT Process and Key Principles

All economic activities, both direct and secondary, in the EUT are classified using NACE codes (as provided in Regulation (EC) No. 1893/2006 of the European Parliament and the Council of 20 December 2006). Subsequently, eligibility/compliance of the activities is considered, and related technical screening criteria defined in Commission Delegated Regulation (EU) No. 2021/2139 of 4 June 2021 are evaluated. Key principles of activities’, services’ and products’ sustainability are as follows:

- Substantially contributing to at least one of the six goals;

- The DNSH – “Do no significant harm” - principle for the remaining EUT goals; and

- Complying with minimum guarantees (e.g. the OECD Guidelines for Multinational Enterprises, the UN Guiding Principles for Business and Human Rights).

Following upon results of the steps described above, companies should determine and monitor so-called performance indicators and modify the enterprise’s strategy and policies accordingly, if needed.

EUT Reporting and Mandatory Performance Indicators (KPIs)

Specific mandatory performance indicators exist in the EU Taxonomy; those indicators have to be published by companies in their annual reports. The indicators are designed to provide a picture of how the company contributes to environmental goals.

Non-financial enterprises report the following: proportion of the turnover attributable to products or services related to sustainable activities under the taxonomy, proportion of capital (CapEx) and operating (OpEx) expenses related to assets or procedures associated with EUT sustainable activities.

Financial enterprises report the following: as specified for non-financial enterprises; banks and investors have to newly report specific indicators of ratios of loans and investments they provided for “green projects” against sustainable activities’ taxonomy criteria starting in 2024 (for the financial year of 2023), namely the GAR (green asset ratio) indicator, which indicates the proportion of exposures in compliance with the taxonomy (so-called taxonomy-aligned).

EUT Context and European Green Deal

In 2020, the European Parliament approved the European Green Deal (hereinafter the “Deal”) with ambitious goals of transforming the EU economy into a modern, competitive economy, which efficiently uses its resources. The Deal’s targets include the following:

- Climate neutrality (reduction of green gas emissions to zero by the end of 2050);

- Sustainable economy (minimisation of waste and maximisation of resources’ reuse); and

- Fair transformation (providing for fair transformation for all regions and citizens).

In order to achieve this goal, fast capital inflow toward sustainable investments is crucial. The level of investments needed to mitigate the climate change and to adopt to it is well known. The OECD estimate that additional investments in the amount of USD 630 billion will globally be needed in this decade on an annual basis to have a 66% chance to reduce a temperature increase on the Earth’s surface to less than 2 degrees. The EU Taxonomy, the second most important EU business sustainability framework, is to assist in this.

Long-term benefits of the EUT are remaining a question, difficult implementation and preparation of companies for the EUT in a short period of time (combined with other CSRD Directive’s requirements) being the major problems. A German study Companies & ESG prepared by Deutsches Aktieninstitut e.V shows that 41% of respondents were critical with regard to the cost/benefit ratio related to the green turnover, operating expenses (OpEx) and capital expenses (CapEx) in a study held in 2022. This percentage of sceptical respondents has grown to three fourths by now, and the time will show how realistic the outcome of investments’ redirection to “green” ones is.

If you are interested in this topic and wish to receive more information or share a comment, please feel free to contact us.

Jiří Vidiečan

vidiecan@clarksonhyde.cz