Amendment to the Act on Company Transformations

Dear Readers,

Today’s article will inform you about latest developments in the area of company transformations, which will be brought along by a currently discussed amendment to Act No. 125/2008 Coll., on Transformations of Corporations and Cooperatives, Parliamentary Press No. 459. The primary reason for this law’s amendment is to transpose the EU Directive on cross-border conversions, mergers and divisions. Those terms have already been known and regulated in Czech standards even though it is not a rule in the EU. Upon transposing the EU Directive, laws in the EU states will be harmonised, which will result in establishing an environment where cross-border company transformations will be easier to implement.

New Form of Transformation: Separation

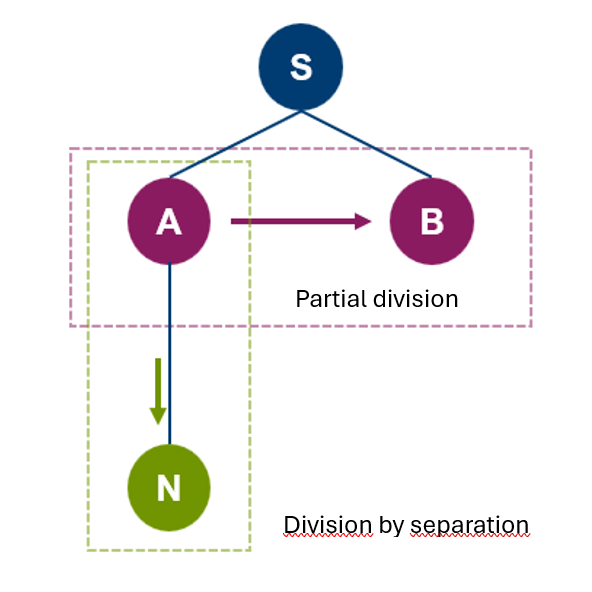

The amendment introduces a new form of transformation, specifically division by separation. The diagram below illustrates a difference between partial division and division by separation.

At present, the law enables partial division from a company being divided (A) into a recipient company (B). The recipient company (B) becomes a sister of the company being divided.

In the event of division by separation, assets are separated from a company being divided (A) into a recipient company (N). The company being divided (A) becomes the sole owner of the recipient company (in the event of separation with a new company’s formation), and/or acquires an investment in the recipient company (in the event of separation by merger). In a division by separation, the recipient company will be the legal successor in the separated assets from the company being divided.

Separation can result in several subsidiaries at the same time or in a division by separation into an existing company, in which the company being divided will acquire an ownership share, or a combination thereof.

According to the explanatory report, division by separation will clarify situations where, under the current practices, a subsidiary is first established and a portion of assets is subsequently transferred or a contributed to the equity of the new company.

In a division by separation, the share capital’s level in the recipient company cannot be higher than the value of the separated assets, which is to be passed from the company being divided onto the recipient company. In this case, an obligation to have the separated assets evaluated by an expert in the case of a new company’s formation or in the event of an increase in the recipient company’s share capital applies.

From the tax perspective, it is vital to correctly determine the share’s acquisition price pursuant to Section 24 (7) of the Income Tax Act. It is also worth mentioning that no such thing as a time test transfer for exemption of the share’s sale after the expiry of 12 months exists in a division by separation, while such time test is transferred in the case of a partial division for the parent company. Revaluation from that transformation will not be tax effective. The recipient company is in the position of a legal successor in relation to the separated capital.

Assets’ Valuation

In section 13b of the Act on Transformation, the amendment supplements a provision on a potential alternative to assets’ valuation on the basis of an expert opinion in cases where required by this law. Exceptions from this duty are copying Section 468 et seq. of the Act on Corporations.

If decided by a company’s Board of Directors:

- Weighted average prices can be used in investment securities or money market instruments pursuant to the Act on Capital Market Business, such prices being prices, for which transactions with the concerned security or instrument were carried out on one or more European regulated markets within the period of six months prior to the contribution (Section 468 (1) of the Act on Corporations);

- Fair value determined by a generally reputable independent expert can be used in assets other than those specified in the first section above while following generally accepted valuation standards and principles no greater than six months prior to the contribution (Section 469 (1) of the Act on Corporations); and

- In relation to assets other than those specified in the first section above and where such assets are recognised at fair value by the depreciating party pursuant to another law, that fair value can be used in determining the assets’ price, if that fair value is disclosed in the financial statements for the accounting period preceding the General Meeting that decided on such contribution, if those financial statements were audited with an opinion without qualifications (Section 469 (2) of the Act on Corporations).

The draft amendment is also expected to eliminate the duty to have an expert appointed by a court. Newly, the expert will have to be selected from an expert list maintained in compliance with the law regulating experts’ activities. The reason for this change is to reduce the excessive quantity of courts’ administrative tasks.

Reference Date

Under the draft amendment, it is prohibited for the date preceding the date of a participating company’s or cooperative’s formation to be a merger’s or division’s reference date, and the draft amendment contains a provision whereby companies and cooperatives can participate in more than one transformation with the same reference date.

Final Financial Statements

The draft amendment also contains a new obligation to prepare final financial statements and opening balance sheets.

Final financial statements as of the date preceding the reference date have to be prepared also by a recipient company or cooperative in the case of a merger by acquisition or a division by acquisition, a company being divided in a division by separation, and a company being divided in an assets’ transfer to a partner.

An opening balance sheet as of the reference date has to be prepared also by a company being divided in the case of a division by separation and a receiving partner in an assets’ transfer to a partner.

It can also be mentioned that the amendment will enable cross-border conversions of registered offices to countries other than the EU member states or outside the EEA. Notaries public who will suspect that laws of the Czech Republic or the EU are being circumvented or evaded or that crimes are committed in connection with a cross-border transformation will be able to approach a public authority for the purpose of considering the cross-border transformation’s lawfulness. The public authority will then assist the notary public, upon request, free of charge and within an adequate deadline.

The draft amendment to the Act on Transformations was supplemented with motions to amend the draft in the second reading in the Chamber of Deputies on 27 February 2024 and forwarded to the Constitutional and Legal Committee, which recommended that the amendment be approved in the wording of those motions. The draft amendment is to be discussed in the third reading. As the deadline for the Directive’s transposition into Czech laws expired on 31 January 2023, the amendment is expected to come into force on the 30th day from the announcement thereof in the Collection of Laws.

We will keep you informed about the legislative process’ progress.

Marek Švanda Marek Kopejtko

svanda@clarksonhyde.cz kopejtko@clarksonhyde.cz