Allowances for Employees’ Catering from the Tax Perspective

The consolidation package brought along a number of changes in the Income Tax Act that have had an impact on taxation of employee benefits (among other things). Effective since 1 January 2024, so-called leisure time benefits are no longer tax exempt without any thresholds on the employee’s part (healthcare services, medical goods, use of educational facilities, etc.).

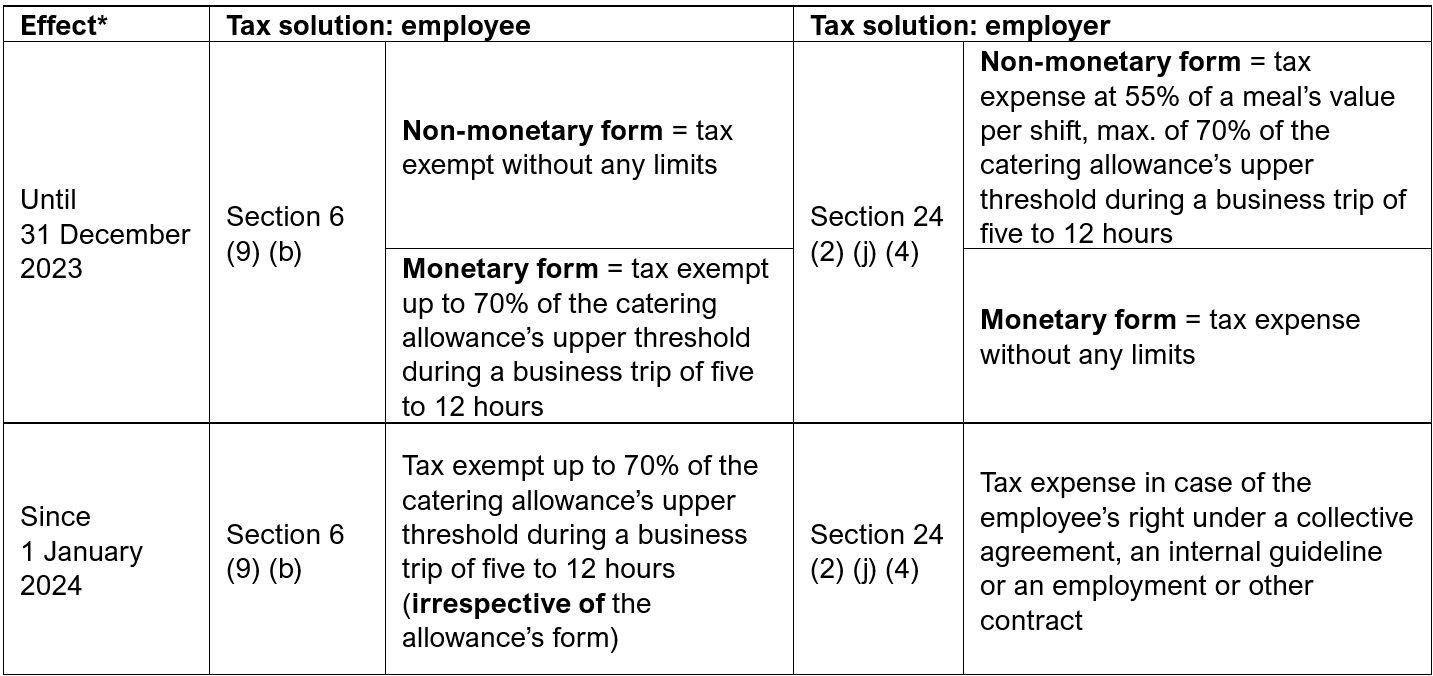

Please find below a summary of information about catering allowances provided to employees by employers, the regulation of which has also been affected by the consolidation package.

Allowances for Employees’ Catering before 31 December 2023

The Income Tax Act (the “ITA”) provided tax exemption for non-monetary forms of catering without any thresholds on the employee’s part until the end of 2023. In case of monetary forms, the allowance was exempt up to 70% of the limit of catering allowances, which could be provided to employees rewarded by salary in the event of a business trip of five to 12 hours.

The tax solution on the employer’s part was governed by Section 24 (2) (j) (4) of the ITA. A monetary allowance was tax deductible without any limits, while only an allowance of no more than 55% of a meal’s price per shift, but only up to the maximum of 70% of the upper limit of the catering allowances provided in the event of a business trip of five to 12 hours, was considered tax-deductible expense in the non-monetary form. In both cases, tax deductibility was conditioned upon the employee’s presence on the shift for a minimum of three hours and the fact that the employee was not entitled to a catering allowance under the Labour Code during the shift.

Allowances for Employees’ Catering since 1 January 2024

The consolidation package has unified conditions for exemption on the employees’ part, for both the allowance’s non-monetary and monetary form. From 2024, catering allowance on the employees’ part has been tax exempt up to 70% of the threshold on allowances, which can be provided to employees rewarded by salary during a business trip of five to 12 hours (as a result, the exemption threshold amounts to CZK 116.20 for 2024).

For an allowance to be tax exempt, a minimum of three 3 hours on a shift have to be worked (where shift work applies) and the employee cannot be entitled to a catering allowance as part of travel allowances during the shift. If performance of dependent activities is not structured into shifts, a minimum of three hours during a calendar day have to worked.

The tax exemption thresholds also apply to the second allowance during the same shift (or the same calendar day, as appropriate) longer than 11 hours.

The employer’s tax expense is newly constituted by a catering allowance, if the employee’s right under the employer’s internal guideline or an employment or other contract is involved.

Table: Summary of Catering Allowances

*Act No. 586/1992 Coll., on Income Taxes, as amended as of the article’s publishing (the “ITA”)

Providing Catering to Former Employees

However, changes in the consolidation package that make tax exemption conditional on hours worked on a shift / calendar day made the same exemption for former employees impossible. An adequate modification was therefore made by so-called technical amendment to the consolidation package (Act No. 163/2024 Coll., Parliamentary Press No. 570; available here).

Income of a former employee who worked for the employer at the time of his or her leaving for old-age or disability pension (3rd degree) is exempt under a new dedicated provision in Section 6 (9) (t) of the ITA in a total of up to 70% of the upper threshold on allowances, which can be provided to employees rewarded by salary during a business trip of five to 12 hours. Even though the amendment came into force on 1 July 2024, the concerned provision can be applied retrospectively from 1 January 2024 under transitional provisions.

Monetary catering allowances provided to a former employee or an allowance provided for example in the form of a multi-purpose voucher, which can also be used for purposes other than catering (in such case, a non-monetary allowance designed for direct consumption is not involved) continue to be tax non-deductible in terms of income tax.

Summarised information is also available on the Financial Administration’s website.

Refreshments at Workplace, Business Lunches

The above paragraphs deal with catering allowances, which replace a complete form of catering, i.e. of a main dish intensity. In case of small refreshments, food or snacks, which are available to employees at their workplace and do not reach the main dish / catering intensity, lawmakers prefer an alternative where such income is not subject to tax from dependent activities pursuant to Section 6 (7) (e) of the ITA, as indicated by an explanatory memorandum to the consolidation package and methodological guidance of the General Financial Directorate (available here). The guidance contains an enumeration of situations and conditions, under which such income is not subject to tax.

Additional items, to which the above-described tax concept of catering does not apply, include business breakfasts, lunches and dinners with clients that are considered performance of work for an employer. Where such meals are part of performing one’s work, they do not involve provision of catering, which the employer is obliged to arrange pursuant to Section 236 of the Labour Code, and the principle of adequacy is met, such employee’s income will not be subject to tax (see the methodological guidance of the General Financial Directorate).

The above-provided information is not intended to replace a tax advisor’s opinion. If you need to consider a particular situation, please feel free to contact us. We are ready to help you.

Michaela Kozminská

kozminska@clarksonhyde.cz